Providers

Increasing healthcare insurance premiums and high deductible insurance plans are resulting in higher patient debt and undermining hospital cash flow.

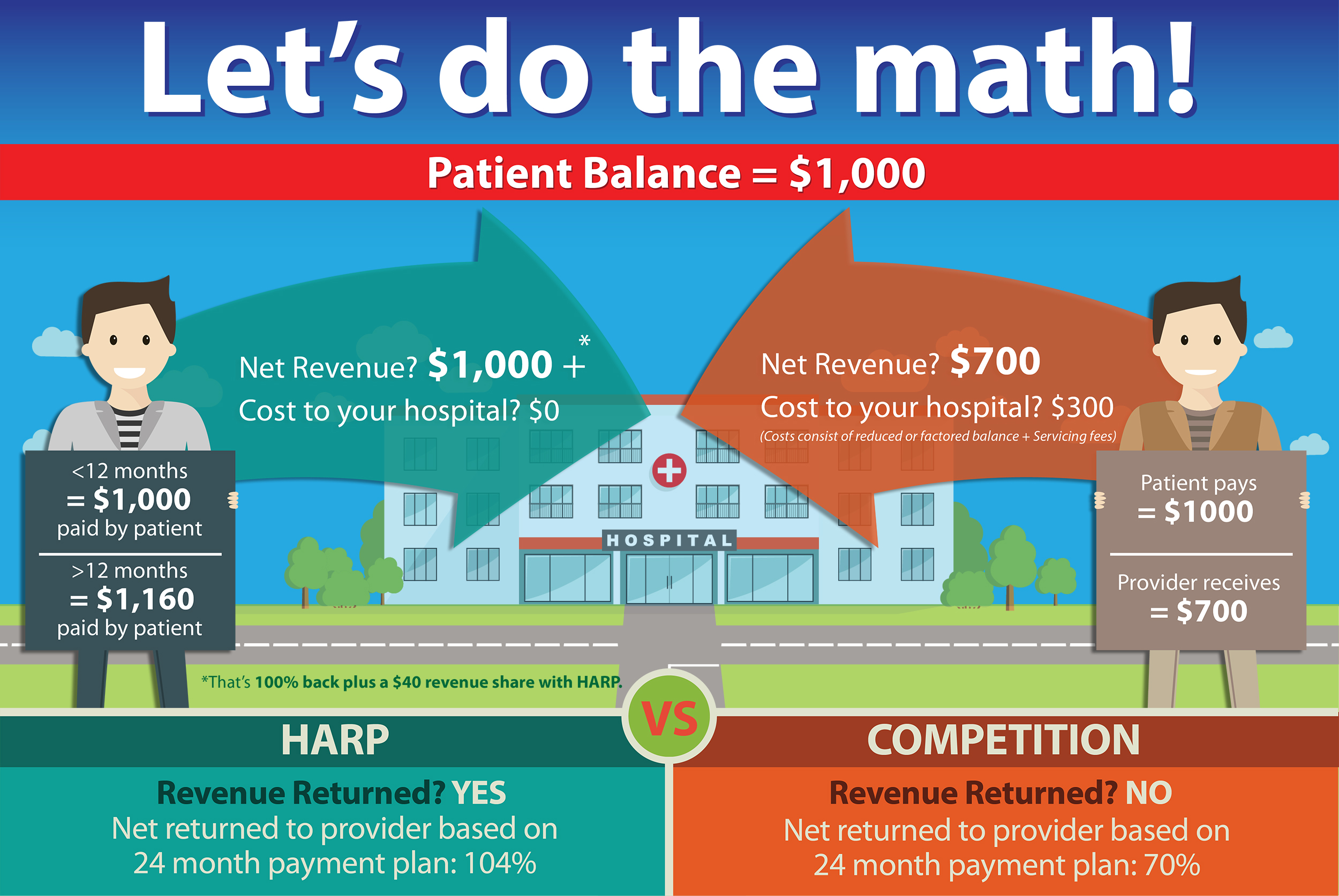

Accounts Billing Service (ABS) provides a service at no additional cost to the hospitals, called HARP, Healthcare Affordable Repayment Plans. These plans offer patients an affordable interest bearing finance option to pay off their medical bills in 12-48 months (at client discretion). The nominal interest added also incentivizes many patients to opt to short term payment plans without interest or finance charges.

According to Modern Healthcare, in a few years providers could see a 50% increase in the amount they’re receiving directly from patients. As the healthcare industry climate changes, many providers are searching for a new solution to reduce bad debt assignments while increasing revenues.

Learn more about this program in this article from insideARM.

Undermining Hospital Cash Flow:

(source: Kaiser Family Foundation)

By adding HARP, hospitals are able to accelerate repayment of patient balances, plus gain a portion of the revenue from interest paid.

The most important benefit of this program is that you’re able to maintain positive customer relations. Your organization’s main goal is to keep your patients healthy and happy. Let ABS assist them in remaining financially healthy.

By opting into the HARP program, it allows patients to:

- Protect their credit

- Remain out of bad debt collection

- Finance medical bills at a low interest rate. While helping your patients, you’re generating revenue and improving collection rates. At no additional cost, you will see a positive impact on your hospital’s bottom line.

- Extend their time to pay off medical bills

While helping your patients, you’re generating revenue and improving collection rates. At no additional cost, you will see a positive impact on your hospital’s bottom line.

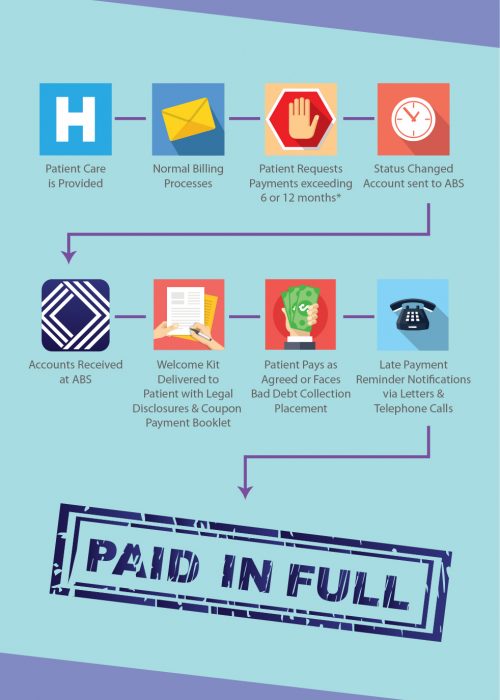

So, how does this program work?

After patient care is provided, patients may request a payment plan that exceeds 6-12 months. If the patient agrees to be contacted by ABS, who is now acting as your loan officer, you will transfer the patient’s data to ABS. Once received, ABS will send a welcome packet to the patient including legal documents to sign and a coupon payment booklet. If the patient agrees, signs and returns the packet, they will begin paying as per their signed agreement. If they opt out of this option, their account will be closed and will be placed in bad debt collection. If they miss a payment, they will begin to receive late payment reminders.

Loan Calculator

Third Party Repayment Calculator provided for demonstration purposes only by Financial-Calculators.com

HARP Representatives will provide actual Repayment Plan documents to patient in mail upon provider request

Currency and Date Conventions

Cash flow forecast…

Charts

Help

Message

The Benefits of Joining HARP

Preserves cash flow. Improves customer relations. Generates income. Improves collection rates. Decreases debt write-offs. Reduces the need for extra servicing staff. No extra expense.

Organization's Responsibilities

So what’s your healthcare organization’s responsibility? Your part in this free service is very minimal as explained below.

- Offer long term payment options to patients needing their plan to exceed 6-12 months.

- Ask patient if you can have ABS send a welcome packet to them. Explain that ABS acts as your loan officer, specifically working with your hospital to help patients easily pay back their medical expenses.

- Once patient agrees, transfer patient data to ABS via secure email, call transfer or web portal.

HARP will handle the account from there at no added expense to the organization. Our goal is to accelerate medical repayment of 100% of your principal balances billed; plus share a portion of the revenue from interest paid.

Simplify Your Billing

Whether you need a Revenue Cycle Management specialist or someone to handle all billing processes, Credit Bureau Systems can help build a package of services to meet your organization’s needs. Increase your debt recovery rates and simplify your billing process.